Living in the UK as a U.S. citizen, Green Card holder, or resident alien means you have to follow the same U.S. tax and financial reporting rules as people living in the States. One thing that’s really important, but often not clear, is filing the Report of Foreign Bank and Financial Accounts (FBAR) every year, which is officially called FinCEN Form 114.

This guide explains the FBAR rules for U.S. people living in the U.K. It covers who needs to file, what needs to be reported, how to figure out the balances, and the steps to filing.

1. What’s the FBAR, and Do I Have to File It?

The FBAR is a way for the U.S. government to fight tax cheating and money laundering, as part of the Bank Secrecy Act (BSA). The important thing to remember is that filing an FBAR just gives information; it doesn’t mean you owe any taxes.

Who Has to File?

You have to file an FBAR if you’re a U.S. person and both of these things are true:

1. You have a financial interest in or can sign for one or more financial accounts outside the U.S.

2. The total value of all your foreign financial accounts was over $10,000 at any point during the year.

- U.S. Person: This includes U.S. citizens, Green Card holders, and resident aliens who pass the Substantial Presence Test. It also includes U.S. companies like corporations, partnerships, LLCs, trusts, and estates.

- The $10,000 Limit: This is the total highest amount in all your foreign accounts combined. If the total went over $10,000 even for one day, you have to report all your accounts, even if they have very little or no money in them.

What Counts as a Foreign Financial Account in the UK?

For FBAR purposes, any account at a financial place outside the U.S. is a foreign financial account. This usually includes these kinds of U.K. accounts:

Bank Accounts: Checking accounts, savings accounts, and fixed-term deposit accounts.

Investment/Brokerage Accounts: Accounts that hold stocks, bonds, or other investments.

Mutual Funds/Collective Investments: This includes non-U.S. mutual funds (these might have other reporting needed, like Form 8621, because of PFIC rules).

Foreign Pension Schemes: U.K. pensions like Self-Invested Personal Pensions (SIPPs) and private workplace pensions often count as accounts you need to report.

Certain Life Insurance/Annuity Policies: Policies that have a cash value or can be cashed out.

Individual Savings Accounts (ISAs): These U.K. savings plans are considered foreign financial accounts that you have to report.

2. How to Figure Out the Maximum Account Value

The FBAR asks you to report the most each account was worth during the year (January 1 to December 31).

The Three Steps to Calculate:

1. Find the Highest Value in British Pounds (GBP): Look at your account statements from each month or period and find the highest amount that was in each account during the whole year.

2. Change It to U.S. Dollars (USD): You have to change the highest value of each account into U.S. dollars using the exchange rate from the Treasury’s Financial Management Service (FMS) for December 31 of the year you’re reporting. You have to use this specific year-end rate, no matter when the highest balance happened.

3. Round Up: Round the final U.S. dollar amount to the next whole dollar.

Example:

- You have a bank account in the U.K.

- The most money in it during the year was £8,500 on July 15.

- The Treasury’s exchange rate on December 31 is £1 = $1.25.

- Calculation: £8,500 x 1.25 = $10,625.

- FBAR Value: You would report $10,625 (no need to round up because it’s already a whole number).

If you have more than one account, do this for each one and then add up all the totals to make sure you went over the $10,000 limit for filing.

3. How to File the FBAR and When It’s Due

The FBAR, which is FinCEN Form 114, doesn’t get filed with your U.S. tax return (Form 1040). You have to file it online with the Financial Crimes Enforcement Network (FinCEN).

How to File

Must File Online: The FBAR has to be filed online through the BSA E-Filing System on the FinCEN website. You can only file a paper form if FinCEN says you don’t have to file online.

Deadlines

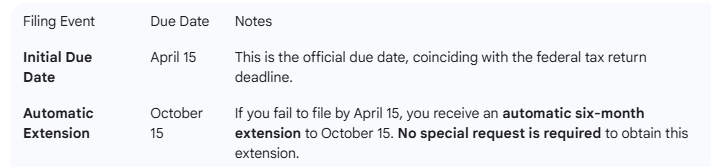

For U.S. people living in other countries, the FBAR deadlines are very helpful:

Note: This automatic extension to October 15 simplifies compliance greatly for expats in the U.K.

What You Need to File

You’ll need to find this information for every foreign financial account you have to report:

- Account Owner Information: Your name, address (U.K. address), and SSN or ITIN.

- Financial Institution Information: The official name and address of the U.K. bank or financial institution.

- Account Number(s): The full account number(s).

- Account Type: e.g., Savings, Current, Securities, Other.

- Maximum Account Value: The maximum USD value for the calendar year, rounded up to the nearest dollar.

4. What Happens If You Don’t Follow the Rules

The penalties for failure to file an FBAR can be severe, emphasizing the importance of timely and accurate reporting.

If you didn’t file FBARs in past years, the IRS has programs like the Streamlined Filing Compliance Procedures for people who made honest mistakes. These programs let you catch up and often lower or get rid of the penalties.

5. ❓ Frequently Asked Questions (FBAR for UK Residents)

Q: Do I need to report my UK ISA (Individual Savings Account) on the FBAR?

A: Yes. An ISA is seen as a foreign financial account for U.S. tax rules. You have to report it on the FBAR if the total of all your foreign accounts is over $10,000 at any point during the year.

Q: Do I need to report my UK pension (SIPP, workplace pension, etc.) on the FBAR?

A: Usually, yes. Most U.K. pension plans, like SIPPs, defined contribution plans, and other retirement accounts from other countries, are considered foreign financial accounts. You have to report them on the FBAR if you meet the filing limit.

Q: I live in another country and file my tax return with the IRS by June 15. Is the FBAR deadline also June 15?

A: No. While U.S. people living in other countries get more time to file their tax return (until June 15), the FBAR is still officially due on April 15. But, if you miss the April 15 FBAR deadline, you get an automatic extension until October 15.

Q: I only went over the $10,000 limit for one day. Do I still have to file?

A: Yes. You have to file the FBAR if the total value of all your foreign accounts was over $10,000 at any time during the year.

Q: I have a joint account with my spouse (who isn’t from the U.S.) in the UK. Do we both need to file?

A: Usually, yes, unless you meet a specific exception. The general rule is that every U.S. person who has a financial interest in or can sign for a foreign account has to report the account. Each spouse has to report the full value (100%) of the account held together. But, spouses can file one FBAR for all accounts they own together if all the accounts that need to be reported are owned together and FinCEN Form 114a is signed and kept as proof. If the spouse who isn’t filing has any separate foreign accounts, this exception doesn’t count.

Q: The most money in my account was in British Pounds. How do I change it to U.S. dollars for the FBAR?**

A: You have to use the exchange rate from the Treasury’s Financial Management Service (FMS) for December 31 of the year you’re reporting. Don’t use the rate from the day the balance was highest. Change the highest GBP balance using the year-end rate and round the result up to the nearest dollar.

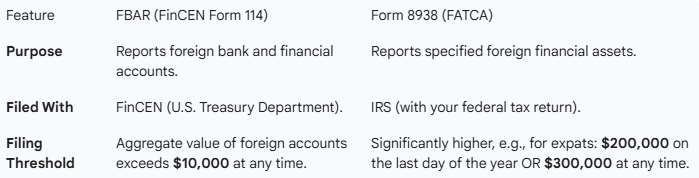

Q: What’s the difference between FBAR and Form 8938 (FATCA)?

A: These are two different ways of reporting:

You might have to file one, both, or neither, depending on how much money is in your accounts.

Disclaimer: while we aim to spark your interest and keep things entertaining, please treat everything shared here as food for thought rather than a rulebook for life. Since we don’t have a crystal ball and your situation is as unique as a fingerprint, we cannot guarantee accuracy or specific results, nor should you rely on this as professional advice. Please take these insights with a grain of salt, do your own homework, and always consult a qualified expert before making any big moves—because what works for one person might not work for all!

Leave a Reply